- #Turbotax 2015 free home and business upgrade#

- #Turbotax 2015 free home and business full#

- #Turbotax 2015 free home and business software#

#Turbotax 2015 free home and business software#

(So, if you call, threaten to jump ship and don't settle for less than an upgrade.)Īlternately, those who don't like kvetching or don't want to pay for Premier in future years, can switch-at little expense or for free-from market leader TurboTax to H&R Block software or to TaxAct.

#Turbotax 2015 free home and business upgrade#

Meighan assured Forbes yesterday that every agent at that number “has discretion to do what’s necessary” to keep a customer- meaning, he said, they will give customers a free upgrade if they demand it, or a discounted one if that’s enough to keep them. One is to call Intuit (at 80, from 8 AM to 8 PM EST) and demand satisfaction. By God, that’s an arrogant way to do business.” Unhappiness with the change is sufficiently widespread that as of this morning TurboTax Deluxe had just 1 ½ stars (out of 5) from Amazon customer reviewers, down from the 4 stars the 2013 version garnered.ĭissatisfied customers do have options, however. “And now, they’re saying we’re going to encourage you to go to Premier not by making it even better, but by taking things away. “You had a product that people were happy with and like me had been buying year after year because it did the job,’’ says Olsen, who had been using TurboTax Deluxe to prepare and E-file the Schedule C for his business. But unlike last year, they’ll be blocked from E-filing those forms or doing that final accuracy review, which is part of the service buyers have come to expect.

#Turbotax 2015 free home and business full#

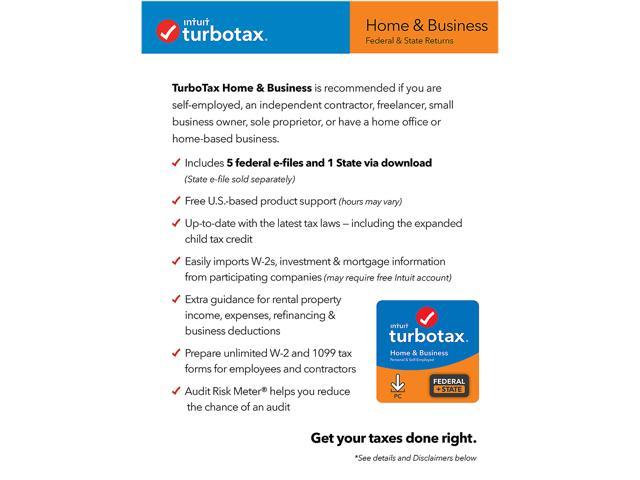

TurboTax Vice-President Bob Meighan confirmed that tax-savvy users of the Deluxe version can still complete full schedules C, D, E or F using TurboTax’s “forms” as opposed to its “interview” method. To E-file, you’ll need TurboTax Home & Business (lists at $109.99, selling for $99.99 on TurboTax and $89.97 on Amazon). For a sole proprietorship with more than $100 of deductions in certain categories, even Premier won’t do. While you can report dividends and mutual fund capital gain distributions through Deluxe, investors who sold any stock or assets need to trade up to TurboTax Premier (list $99.99, selling for $89.99 through TurboTax’s site and $79.97 on Amazon) to E-file.

But you can no longer use Deluxe to electronically file a Schedule D, for capital gains and losses Schedule C, for profit and loss from a sole proprietorship business Schedule E, for rental real estate, royalties and distributions from partnerships or Schedule F, for farm income. What’s riling Olsen and other long-time users is this: the boxed software/download version of TurboTax Deluxe + State for 2014 lists for the same $69.99 as did the 2013 version (you can currently buy the 2014 version for $59.99 on the TurboTax site and $49.97 on Amazon).

0 kommentar(er)

0 kommentar(er)